Going the Distance

This week in Strategic Insights: There will be no wire-to-wire win for equities this year. The volatility that has characterized equities in 2015 was ever present again this week.

Economic Commentary

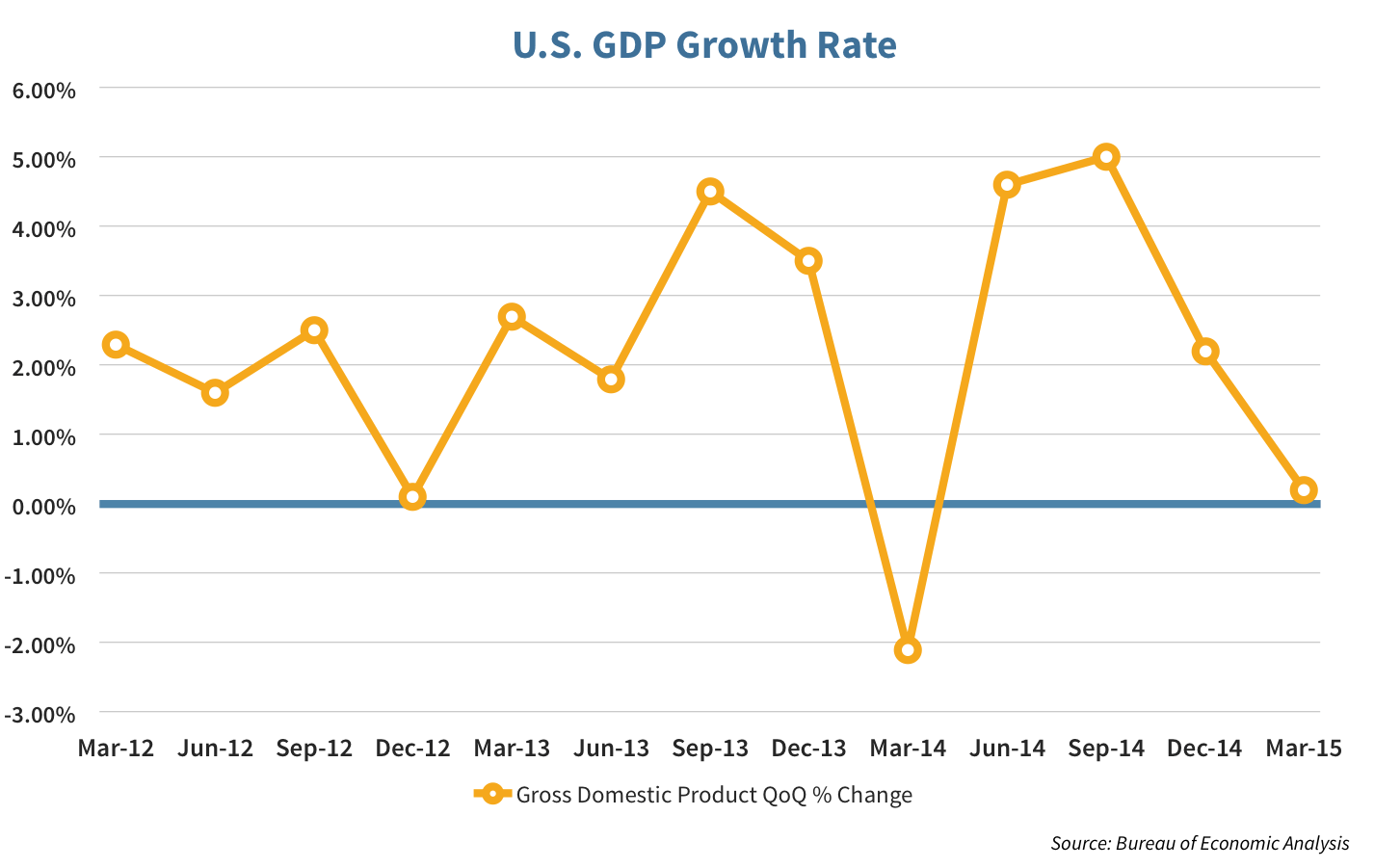

Stop-and-start pattern of economic growth persists as GDP numbers for Q1 were lower than expected.

Slow out of the gates

The growth in real GDP, a broad inflation-adjusted measure reflecting the goods and services produced in the U.S., came in at 0.2% for Q1. Although the GDP figure was substantially higher than the -2.1% for Q1 of 2014, it was lower than consensus expectations of +1.0%.

- Relative to last year, the low GDP growth number was driven by cuts in business investment, lower exports and a cautious consumer.

Missed the Mark

Q1’s real GDP didn’t quite hit the projected +1.0%.

The view from Millionaire’s Row

According to the Fed, investors should not read too much into the low GDP number. The Fed cited ‘transitory factors’, such as a harsh winter, as a cause for low growth.

- The impact of a harsh winter on economic readings will dissipate as we move further into the year. Questions remain however if other headwinds such as low oil prices, strong dollar and a cautious consumer will prove to be as transitory.

Odds falling

Disappointing Q1 GDP figures have become a recurring theme. Since 2010, Q1 GDP growth has averaged 0.6% relative to 2.9% for rest of the year.

- Although forecasters expect a rebound similar to the one seen last year, the extent of the rebound is not yet certain given macroeconomic headwinds such as the strong dollar. The odds of a rate hike for 2015 however has likely gone down.

Market Review

There will be no wire-to-wire win for equities this year. The volatility that has characterized equities in 2015 was ever present again this week.

Stumbled

Equities got off to a rough start this week on weak Q1 GDP figures and The Fed’s indifference.

- The Fed sees the Q1 weakness as “transitory”. It would appear the finish line for stimulus remains.

- As a result, the S&P500 ended the week in negative territory, despite an impressive run down the stretch.

I am the greatest, I said that even before I knew I was.

Muhammad Ali

The gloves are off

The media landscape is changing at an unprecedented rate thanks to rising contenders like Netflix (NFLX) and Hulu with their cord-cutting fans. The fight for relevance took an interesting turn this week.

- Media heavyweights Comcast (CMCSA) and Time Warner Cable (TWC) called off their proposed merger following regulatory scrutiny. Both will have to find other means of maintaining their competitive fitness.

- Verizon (VZ) threw a sucker-punch, offering “featherweight” bundles which carve off Disney’s (DIS) ESPN and other sports channels into standalone offerings. With Disney suing, the battle between these two Strategic holdings looks destined for court.

Looking Ahead to Next Week

The Money Team

Saturday’s highly anticipated boxing match between Floyd Mayweather and Manny Pacquiao brings with it some impressive economics:

- In addition to a $25k gold/diamond mouth guard, $2M in ad space on shorts and $1,500 nose bleed seats, the $300M-$400M est. in pay-per-view sales should benefit Strategic holding Time Warner’s (TWX) HBO network.

Stick and or Move

Friday brings the April jobs report, and the first data of this key metric in the 2nd quarter.

- Following a lackluster Q1 GDP growth number, investors are looking to see if recent weak data is more than just a pause in the domestic economic recovery.

Full Card

A slew of Strategic holdings will report Q1 earnings next week including Disney, HSBC and Prudential.

- Disney reports following this weekend’s release of the latest movie in The Avengers series; the last of which grossed $1.5B worldwide.

Investment Strategy

STRATEGIC Asset Allocation

Overseas Action

Getting up off the mat: After weathering a blistering assault from the supply side, energy markets have rebounded, helping to lift the commodity space.

Down but not out

U.S. markets took a 1-2 punch from weak macro-economic and earnings reports. However, the broad market remained on its feet due to strength in the heavyweight division (Mega-caps).

Split decision

No clear winners are apparent as the judges (Central Bankers) wait for consumers to start punching above their weight.

STRATEGIC Growth

The Baby Race

The Health Care sector was hit with an exacta of unfortunate events; a sell-off in biotech and continued drama in the Mylan NV (MYL) love tringle. In other news…

- Carters Inc. (CRI), the children’s apparel company, reported a route of a quarter, topping earnings and revenue estimates. Double-digit domestic sales growth and full year guidance of 10-14% earnings growth was also a handsome prize.

STRATEGIC Equity Income

On the ropes

A move higher for interest rates was an especially painful upper-cut for utilities and REITs this week. Speaking of taking a few punches…

- HSBC Plc (HSBC) has been playing rope-a-dope for the past few years. The bank has been receiving blows from regulators, especially in the UK. To retaliate, the bank is mulling moving their HQ out of London and spinning off its UK operations. Also, the company has put its Brazil unit up for sale this week.

| Indices & Price Returns | Week | Year |

|---|---|---|

| S&P 500 | -0.4% | 2.4% |

| S&P 400 (Mid Cap) | -1.3% | 4.2% |

| Russell 2000 (Small Cap) | -3.1% | 1.9% |

| MSCI EAFE (Developed International) | -1.0% | 7.8% |

| MSCI Emerging Markets | -1.4% | 9.4% |

| S&P GSCI (Commodities) | 1.9% | 6.1% |

| Gold | 0.0% | -0.4% |

| MSCI U.S. REIT Index | -3.1% | -1.6% |

| Barclays Int Govt Credit | -0.7% | 0.6% |

| Barclays US TIPS | -1.0% | 1.7% |

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Alan Leist III

Alan Leist III