Return of Goldilocks

This week in Strategic Insights: Markets applauded a ‘perfect’ jobs report Friday to rally stocks and retest highs. Investors hope that the economy can resume the recovery and keep the Fed on hold a while longer.

Economic Commentary

The eyes of the investing world were once again focused on the Non-Farm Payroll report Friday. Should long-term investors pay attention to this monthly media circus?

Short-sighted

This month’s Non-Farm Payroll report seems to have struck the Goldilocks balance that the market was hoping for; not too low, not too high. U.S. equity markets rallied and are testing record levels.

- 223K non-farm jobs were created in April. A lower figure (particularly after the poor March print) may have increased concerns that the economic recovery is stalling. A higher figure may have encouraged the Fed to shorten the timetable to a rate rise.

Far-sighted

Do payroll numbers matter for long-term investors? In short, yes; but individual monthly figures cannot be looked at in isolation.

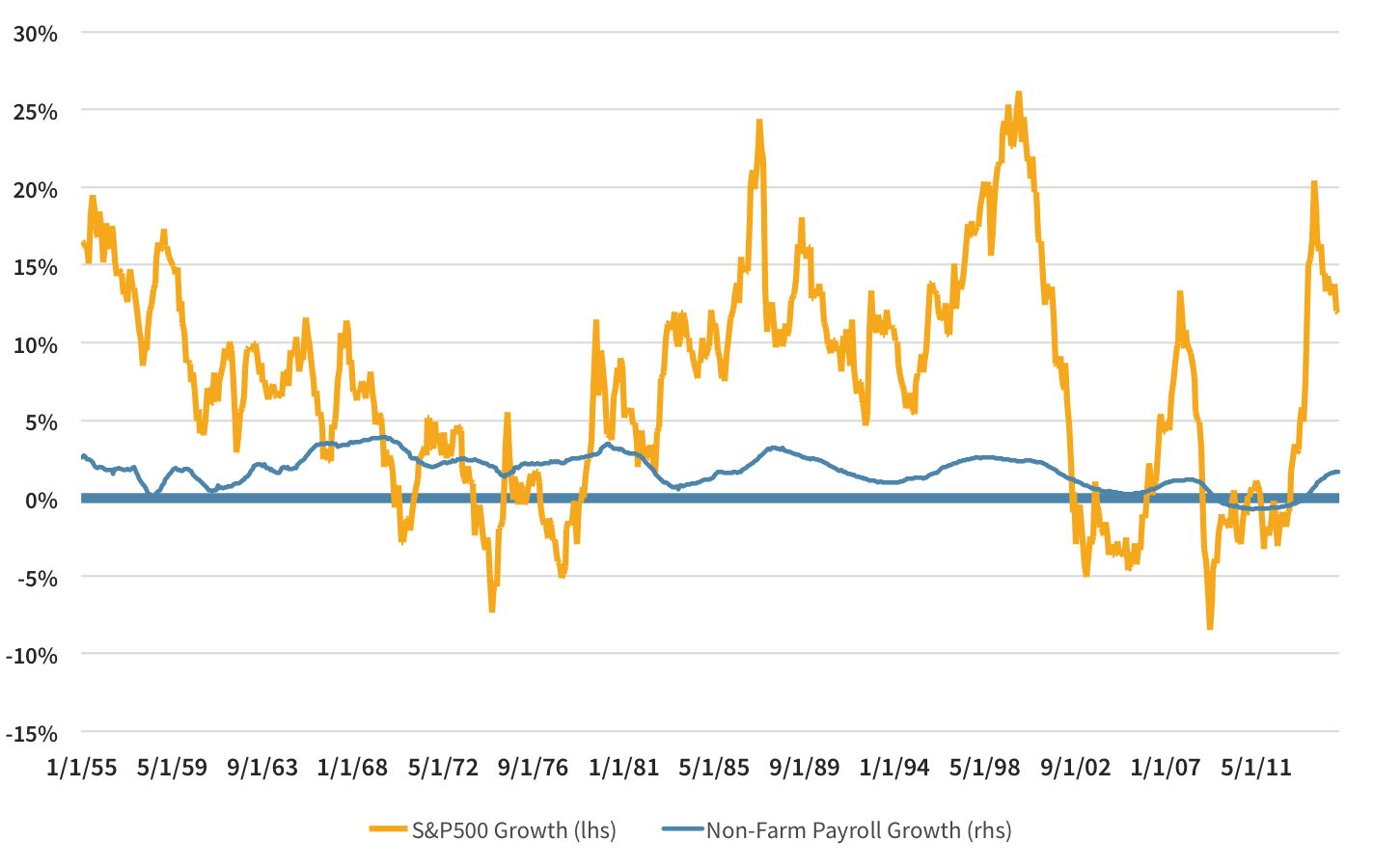

- The chart below compares annualized 5yr returns of the S&P500 to annualized 5yr growth in payrolls. For the past 35 years growing payrolls = growing equities.

- Pre-1980 however, this relationship breaks down. The difference? Growth was too strong, the Fed did not act with conviction and equity markets had to contend with persistently rising inflation.

Where to Focus

Do not lose sleep over the volatile monthly payrolls. Focus on longer time periods which provide a better picture of economic health. In our chart current growth stands at 1.7%; in line with the long term average, just where Goldilocks likes it.

Market Review

Markets applauded a ‘perfect’ jobs report Friday to rally stocks and retest highs. Investors hope that the economy can resume the recovery and keep the Fed on hold a while longer.

High Times

Fed Chair Yellen wandered once again into enemy territory with a warning about stock valuations.

But how do we know when irrational exuberance has unduly escalated asset values…

Alan Greenspan (1996)

- Some may recall past pontifications by Fed chairs including Greenspan’s infamous ‘irrational exuberance’ call of 1996 (followed by a +100% rally).

- Despite past misfires, Yellen has a point in that corporate fundamentals need to strengthen before the next leg higher can begin and be believed.

- According to Factset, earnings growth will come in at less than 1% in Q1 of 2015, a challenging headwind for stocks.

Debt Binge

The WSJ highlighted the pick-up in the pace of borrowing by corporations and consumers alike.

- On one hand, increased borrowing (at record levels in some cases) is a sign of improved confidence.

- On the other hand, we will once again highlight the risk of capital misallocation due to record low interest rates.

GO COMETS!

Utica’s league leading AHL franchise is battling the OK City Barons in the conference semis.

Looking Ahead to Next Week

April Showers

The latest round of monthly consumer spending data (retail sales) which comprises 2/3rds of U.S. economic growth will be released on Wednesday.

- Sales likely slumped in April as the winter hangover extended into the spring, and wages have not kept pace with recent job growth numbers.

Pay Day

Greece faces a May 12th deadline for repayment of €745M in bailout funds to the IMF.

- Greece desperately needs to prove that it is willing to take action regarding its economic woes; failure to do so could result in more stringent bank liquidity rules.

In the Middle

President Obama will host the six-nation Gulf Cooperation Council next week with a common missile defense system slated to top the agenda.

- The summit is in direct response to recent sanctions relief granted to Iran, allowing continued bolstering of its nuclear program and presence in the Gulf Region.

Investment Strategy

STRATEGIC Asset Allocation

After spending much of the past year flattening, the U.S. Treasury curve has started to get steeper with the 10-Year moving higher.

Bund-doggle

The German 10-Year flirted with negative rates before valuation concerns triggered a quick unwind. However, the ECB remains an indiscriminate buyer so more meaningful moves higher seem doubtful.

Patience Remains a Virtue

While yields have become relatively more attractive, our fixed income focus continues to be on capital preservation and mitigating rate risk.

STRATEGIC Growth

The Cognizant of Change

The Energy sector was a notable laggard this week. In other strategy news, one company had an exceptionally good week even before Friday’s rally…

- Cognizant Technology Solutions (CTSH), an outsourcing and consulting company, reported a consensus topping quarter. The company also bumped up guidance. The CEO said in the earnings release “The clients we serve are experiencing tremendous change in their businesses and are increasingly turning to CTSH to navigate that change.”

STRATEGIC Equity Income

On the One Hand…

Spiking rates and steepening yield curve give hope for better days for banks. On the other hand, higher rates due weigh on dividend stocks. In other news…

- McDonalds (MCD) released a much anticipated turnaround plan on Monday. No quick fixes were announced. It may take some time for changes to yield results.

| Indices & Price Returns | Week | Year |

|---|---|---|

| S&P 500 | 0.4% | 2.8% |

| S&P 400 (Mid Cap) | 0.3% | 4.6% |

| Russell 2000 (Small Cap) | 0.6% | 2.5% |

| MSCI EAFE (Developed International) | -1.0% | 6.7% |

| MSCI Emerging Markets | -2.0% | 7.2% |

| S&P GSCI (Commodities) | -0.4% | 5.7% |

| Gold | 0.8% | 0.3% |

| MSCI U.S. REIT Index | 0.5% | -1.1% |

| Barclays Int Govt Credit | 0.0% | 0.7% |

| Barclays US TIPS | -0.6% | 1.1% |

About Strategic

Founded in 1979, Strategic is a leading investment and wealth management firm managing and advising on client assets of over $2 billion.

OverviewDisclosures

Strategic Financial Services, Inc. is a SEC-registered investment advisor. The term “registered” does not imply a certain level of skill or training. “Registered” means the company has filed the necessary documentation to maintain registration as an investment advisor with the Securities and Exchange Commission.

The information contained on this site is for informational purposes and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Every client situation is different. Strategic manages customized portfolios that seek to properly reflect the particular risk and return objectives of each individual client. The discussion of any investments is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. Any representative investments discussed were selected based on a number of factors including recent company news or earnings release. The reader should not assume that an investment identified was or will be profitable. All investments contain risk and may lose value. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Some of the material presented is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Strategic Financial Services believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

No content on this website is intended to provide tax or legal advice. You are advised to seek advice on these matters from separately retained professionals.

All index returns, unless otherwise noted, are presented as price returns and have been obtained from Bloomberg. Indices are unmanaged and cannot be purchased directly by investors.

Doug Walters

Doug Walters